One of the many advantages of your membership in the RWC Warranty Program is the marketing support available for your use. You can enhance your sales strategy for today’s competitive marketplace by taking full advantage of RWC’s marketing essentials. Best of all, they are FREE!

One of the many advantages of your membership in the RWC Warranty Program is the marketing support available for your use. You can enhance your sales strategy for today’s competitive marketplace by taking full advantage of RWC’s marketing essentials. Best of all, they are FREE!

Below are a few examples of what is available, but feel free to browse our marketing materials page to see what best suits your needs. Consumer brochures are also available to pass onto your homeowners so they can better understand the warranty on their home.

- Electrical Box Sticker (form # 204): This self-adhesive sticker makes it easy for your homeowners to find their warranty validation number. Affix this sticker to their electrical box during your final walk-through inspection.

- Small vertical Easel (form # 509): Sometimes space is limited on countertops. When that’s the case and our full-size easel or brochure holder doesn’t fit, try this smaller version. Works great in sales offices and model homes!

- Static Cling Window Decals (form #533): This cling is perfect for windows in model homes, sales offices or even homes under construction. This static cling decal will let your prospective buyers know that their home will be protected with an RWC warranty.

HOW TO ORDER SUPPLIES:

Order Online through Warranty Express (top right corner of webpage). Call us if you still need a password to login.

Email: info@rwcwarranty.com and let us know which items you are interested in.

Phone: 800-247-1812, Ext 2459

We ask that you please order only a 2-3 month supply to ensure that you receive the most current materials.

If you’ve been a builder for more than a few years you’ve been through a lot. When the housing bubble burst; you survived. Now that the market is better and your business is growing, you’re starting to realize the rewards of surviving. There are still plenty of challenges and one of them is to find qualified subcontractors.

If you’ve been a builder for more than a few years you’ve been through a lot. When the housing bubble burst; you survived. Now that the market is better and your business is growing, you’re starting to realize the rewards of surviving. There are still plenty of challenges and one of them is to find qualified subcontractors.

Recently, you started a new subdivision and hired a flat concrete contractor you’ve never worked with before, to put in the sidewalks. This morning you got a call from your new sub; the kind you never want to get. A woman was walking her dog next to your project around dusk last night. She tripped over a mason’s line that was left across a section of sidewalk that had been poured earlier that day. The new flat work guy left the site without setting up any cones, fencing or signs. In fact, he did nothing to warn the public of what is commonly referred to as a “trip & fall hazard.” The woman suffered fractures to both wrists as well as lacerations to her face when she fell. Her injuries will require surgery and she’ll be unable to work for several months. Her pain and suffering have yet to be determined.

Your new sub has his own general liability insurance that should respond to this claim. You required him to have his insurance company add you to his policy as additional insured. That way they will defend you if and when the woman’s attorney sues you as well as your sub. The certificate of insurance you required your sub to provide shows all of this. Everything should be fine. But, trip & fall claims can spiral out of control.

Disputes can arise over who should have protected the worksite. Subcontractors or, their attorneys, can argue that’s the general contractor’s job. You feel that you don’t have time to hover over every job site making sure each sub is placing the proper emphasis on safety. Besides, you hired them to do a job and that includes doing it safely. Doesn’t it? All your subs understand this, don’t they?

In most states, you as the general contractor, are ultimately responsible for worksite safety. That doesn’t mean the subs get a free pass. But it usually means the general contractor has to do more than just assume everyone is being safe. That means holding periodic safety meetings, making sure new subs understand what you expect from them before starting work each morning, during the workday and after shutting down for the night. Active worksites are dangerous places even when they are nothing more than a partially completed sidewalk in poor light where an unsuspecting woman takes her dog for a walk.

Holding regular safety meetings doesn’t have to take a lot of time or cost you much money. Meetings don’t have to be held every day; just regularly enough to make it clear to everyone concerned that you are committed to preventing accidents involving both the public and anyone else at your worksites.

The RWC Insurance Advantage is dedicated to loss prevention. To prove it, we offer up to 25% off your new general liability premium if you provide us with a copy of your written safety program. If you’re already insured with us, we’ll even offer the same incentive on your next renewal if you haven’t already received it.

Call us today at 866-454-2155 to find out if you qualify and receive a free, no obligation quote.

Today’s home buyers are tech-savvy shoppers who routinely turn to the internet when searching for new homes. As a successful builder, you understand the vital importance of maintaining a solid presence on the internet so potential buyers can find you, learn about what you offer, and discover what makes you better than “the other guys”.

RWC has an entire section of our website dedicated to educating the homebuyer on everything from how to choose a home builder to understanding what a new home warranty is all about. The following resources can help explain the value of your decision to provide an RWC warranty on your home:

RWC has an entire section of our website dedicated to educating the homebuyer on everything from how to choose a home builder to understanding what a new home warranty is all about. The following resources can help explain the value of your decision to provide an RWC warranty on your home:

- The Value of an RWC Warranty to Your Home Buyer

- What Your RWC Membership Means to Your Buyer

- Tips on Choosing a Builder (of course being an RWC Member factors in there)

- What’s the Difference Between a Structural Warranty and an Appliance Warranty

- Important Warranty Terms to Know and Understand

Something ‘extra’ you provide which sets you apart from the competition is the fact you offer a 3rd party insured warranty – and not just any warranty – but the RWC warranty. The sales process is complex with a variety of topics to discuss with potential home buyers. Our goal is to make the warranty explanation easier for you by expanding our online resources for your homebuyers. Hopefully, this section will become your “go to” resource for warranty information for your staff and your buyers.

Obviously, it makes perfect sense to provide your buyers with information about your warranty. Simply link your site to the RWC Homeowner section to point them in the right direction and we’ll tell the story for you! We suggest linking to www.rwcwarranty.com/homeowners as your starting point. Your buyers will learn about the extra mile you travel to demonstrate your professionalism and customer service by providing them with this written RWC warranty.

Did you know that as a member of RWC or HOME of Texas you may be eligible for our General Liability Insurance Program through RWC Insurance Advantage? If you would like to learn how we might meet your general liability coverage needs, call RWC Insurance Advantage today at 866-454-2155 or click here to get a quote. Plus, be sure to read on for some helpful hints about certificates of insurance, subs and staying on top of policies.

Did you know that as a member of RWC or HOME of Texas you may be eligible for our General Liability Insurance Program through RWC Insurance Advantage? If you would like to learn how we might meet your general liability coverage needs, call RWC Insurance Advantage today at 866-454-2155 or click here to get a quote. Plus, be sure to read on for some helpful hints about certificates of insurance, subs and staying on top of policies.

Insurance agents hear it all the time; are certificates really that important? If my subs’ certificates aren’t current, am I on the hook for what their policies don’t cover? What about exclusions on my policy? Maybe a hypothetical claim will help provide some answers. Let’s say you contract with a roofer. He’s not the roofer you usually work with but, he has a good reputation and he gives you a certificate of insurance that shows he has his own General Liability policy. It has the same limits as your policy with the RWC Insurance Advantage program. No worries here. His policy will respond first to injuries or damage to others that he might cause while working on your behalf. However, you also notice his Workers Comp is due to renew in about a week but, he assures you the renewal is going to happen and he’ll provide you with an updated certificate just as soon as he gets it from his agent. You need to get your latest project under roof as soon as possible because the weather has been uncertain; so, you decide to take a chance. Besides, it shouldn’t take a week to do a roof. What could go wrong?

The weather takes a turn for the worse. By the time the roof is started it’s been over a week. Then you get the news one of the roofer’s employees has been injured. He didn’t fall but, he hurt his back. Only then do you remember the promised certificate hasn’t appeared. Then your roofer admits his policy was not renewed because he failed to make a payment. Your policy doesn’t cover injuries to the employees of subcontractors. That’s because workers compensation insurance is available to them and is designed to cover the medical bills and lost wages of his employees. As it turns out, waiting for a renewal certificate of insurance might have avoided you being held liable for a loss that isn’t covered under your policy.

• Make sure all your subcontractors provide you with up-to-date certificates of insurance.

• Ask them if they have any open or, unreported claims.

• Be aware of what your policy does and does not cover.

Don’t let someone else’s lack of planning become your problem.

Source: nahb.com

Whole house remodels and additions are regaining market share according to a 2016 survey of remodelers released by NAHB Remodelers, the remodeling arm of the National Association of Home Builders (NAHB). The survey revealed the most common remodeling projects in 2016, compared to historical results of the survey.

“While bathroom and kitchen remodels remain the most common renovations, basements, whole house remodels and both large and small scale additions are returning to levels not seen since prior to the downturn,” stated the 2016 NAHB Remodelers Chairperson. “Clients want to add more space, but remodeling a significant portion of the home is no easy feat. That’s why it is important to work with a professional remodeler who has the integrity and expertise to take on these large remodeling jobs.”

Remodelers reported that the following projects were more common than in 2013:

Remodelers reported that the following projects were more common than in 2013:

• Whole house remodels increased by 10 percentage points

• Room additions increased by 12 percentage points

• Finished basements increased by 8 percentage points

• Bathroom additions increased by 7 percentage points

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their company while 79 percent of remodelers reported the same for kitchen remodels. Window and door replacements decreased to 36 percent from 45 percent in 2014.

Whether you are currently working on remodeling projects due to the colder weather and frozen ground or because that's what your customers are opting for, Residential Warranty Company, LLC & HOME of Texas have great remodeler warranty options at your fingertips. When it comes to revamping space, creating an addition to a home, or totally reinventing the look and style of a home, homeowners want to know the work is being done by a quality, professional remodeler. Contractors who offer the RWC warranty / HOME warranty provide clients with written, insured warranty protection, including a dispute resolution process.

It takes a lot of tools to both complete a remodeling project and to build a business. RWC / HOME offer you a great selection of tools. Talk to your account executive today for more details on the remodeler warranty, or any program available in our menu of choices.

Source: proremodeler.com

Source: proremodeler.com

Readers of news articles about the housing industry have been inundated for a while with stories about Millennials and their desire to live in the city. Headlines such as “Millennials Prefer Cities to Suburbs, Subways to Driveways” and “The New American Dream Is Living in a City, Not Owning a House in the Suburbs” popped up frequently. And polling companies provided the data to back it up: The Nielsen Company, for example, reported that 62 percent of young people “like having the world at their fingertips,” preferring to live in “dense, diverse urban villages where social interaction is just outside their front doors.”

But around the middle of 2015, the stories about Millennials started to shift. We began to see more stories like, “Think Millennials Prefer the City? Think Again …” And now, a survey from the National Association of Realtors says that Millennials are finally starting to buy homes. And where are they buying them? That's right, in the ’burbs.

Why all of a sudden the change? Perhaps Millennials are now ready to settle down and start families and prices are cheaper in the suburbs. Or because they want to raise their kids in places that remind them of their own childhood. Whatever the reasons, the numbers show that buyers under the age of 35 now make up the largest share of homebuyers (35 percent) and that 51 percent of them bought homes in the suburbs or in subdivisions.

It stands to reason that these buyers, whose median age is 30, are the leading edge of their generation. As the rest of this generation, 80 million strong, reach their 30s, they will likely follow the same path—research from the Demand Institute says 75 percent of Millennials consider homeownership an important long-term goal and 48 percent say they plan to buy within the next five years. The question is, are you building homes they will want to buy?

So what exactly does this young group want? Turns out they want pretty much the same things almost everyone else wants: a nice neighborhood; good schools; access to public transportation; & convenient outdoor space to walk and exercise. Another requirement is close proximity to social activities such as shops, cafés, and restaurants. As for the house itself, they are looking for an open plan, ample storage, energy efficiency, low-maintenance living, space for easy entertaining, and of course good cell reception. But the single most important thing Millennials are looking for is living within their means in a home they can comfortably afford.

Unfortunately, the problem is, there just aren’t enough new homes being built that Millennials can afford. Because of land and labor costs, zoning and other regulations, most builders are targeting a smaller, more affluent group of buyers. A lot of new homes are large and include more expensive features and amenities. Something that a young, first time home buyer, will probably pass right by because it is out of their price range. A recent study by real estate advisors RCLCO revealed that when first-time buyers considered new and existing homes in their searches, only 18 percent of them bought a new home.

There are some success stories out there, though. RCLCO reports that a concerted effort by some master planned communities to offer a range of product types, such as townhomes, cottage court bungalows, and small single-family homes—in addition to conventional single-family homes — “can still achieve premiums on a dollars-per-square-foot basis.” The company cites the Daybreak master plan near Salt Lake City as a good example of a project that successfully integrates midscale, mid-priced product within a larger community.

Companies that are building more affordable homes and marketing them to Millennials are already starting to reap the rewards. It’s time for more builders to start thinking about creating a product that is attainable for the largest faction of buyers we may ever see.

In addition to a variety of home warranty programs, RWC and HOME of Texas offers unique features to make your membership as effective and efficient for you as possible.

In addition to a variety of home warranty programs, RWC and HOME of Texas offers unique features to make your membership as effective and efficient for you as possible.

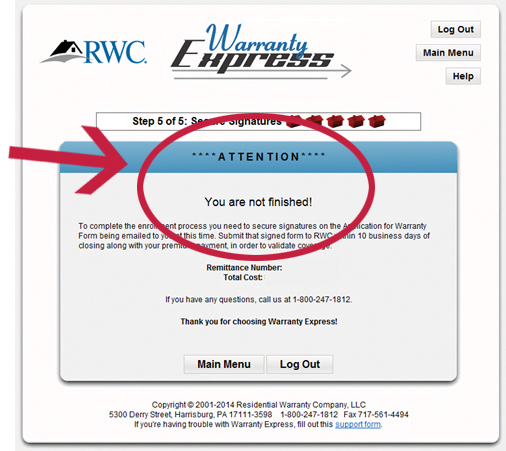

As you know, Warranty Express is our online system for everything from home enrollment to membership renewal to ordering marketing materials and enrollment reports.

We wanted to emphasize an important point about the system when you are enrolling homes online. When you get to the last screen on Warranty Express, it will tell you “You are not finished!”

Why? What do you mean I'm not finished? Well, because we still need the signed Application for Warranty form and payment, if not paid online. (Pay online and save the $6.95 processing fee.)

It’s very important that you submit the signed Application for Warranty form after closing.

The warranty is not valid (even if paid for) if RWC/HOME does not receive the signed Application in order to validate coverage.

If you pay online, the signed Application for Warranty form can be faxed to (717) 561-4494 or emailed to Sandra at Sandra.Sweigert@rwcwarranty.com.

If you are not familiar with Warranty Express, contact your Account Executive for more details.

Who doesn't love a perk that allows you to reap the rewards of something that you already do... provide quality construction and outstanding customer satisfaction. That's right, cash in on YOUR excellent customer service by joining the Incentive Program!

Who doesn't love a perk that allows you to reap the rewards of something that you already do... provide quality construction and outstanding customer satisfaction. That's right, cash in on YOUR excellent customer service by joining the Incentive Program!

Joining the Incentive Program is the best way for our Members to maximize their dollars plus enjoy additional benefits that only this program offers.

RWC established this program over 25 years ago as a way to reward our members for their good claims experience. Since then, RWC and affiliates have distributed $21.5 million in Incentive distributions back to Incentive members.

WHO IS ELIGIBLE?

A Member must enroll at least 20 homes per year or have an annual enrolled sales volume of $2 million. A free analysis illustrating how the Incentive Program can work for you is available upon request.

ADDITIONAL BENEFITS:

• The annual fee of $295 is waived for Incentive Members, saving an additional $1180 in years 2-5 of membership.

• The value of the Incentive distributions greatly reduces the effective cost of the warranty fee.

• The Member enjoys a locked-in enrollment rate under the standard program throughout the duration of their Incentive membership.

HOW DO I JOIN?

If you think your company will meet the eligibility requirements, call us to take the next step in building your own Incentive reward! Contact us at 800-247-1812, Ext 2149 or email sales@rwcwarranty.com.

The online validation process launched October 20th, 2014 by Residential Warranty Company, LLC (RWC) and HOME of Texas (HOME) is, by all accounts, a success! Billed as the next step in the home warranty companies’ modernization plan, the online home enrollment validation system streamlined the process to save time for home warranty members and their homebuyers.

Residential Warranty Company, LLC (RWC), a leading provider of insured home warranties to the building industry nationwide, and HOME of Texas, RWC’s Lone Star State affiliate, have been fairly busy lately enhancing the quality of their home warranty programs and the efficiency of their systems for members. This trend continued as RWC and HOME moved to an online process for home enrollment validation.

Previously, the process had buyers sign paperwork at closing. After RWC/HOME received the signed copy and warranty fee, a validation sticker on a postcard was sent via regular “snail mail.” Depending on how quickly RWC/HOME received the information back from the closing, how timely the enrollments were processed, and how quickly the mail was delivered, it could take several weeks before a validation sticker arrived in the buyer’s mailbox.

Now, homeowners can simply go online to confirm their home warranty coverage. For convenience, homeowners can either print their warranty documents or save these documents as PDFs on their computer. They no longer need to wait for any confirmation to arrive in the mail and are spared the hassle of having to request a duplicate if the original gets lost. Also, and probably best of all, homeowners will enjoy a much speedier confirmation of their new home warranty whenever they choose to login via Warranty Express to retrieve their documentation (warranty book, closing document with info including validation number, effective date of warranty, term of coverage, and any applicable addenda). What’s more, they are able to view the warranty book online that was issued for their home in the future.

For more information on Warranty Express and its benefits, click here.

All of RWC’s home warranty programs feature mandatory binding arbitration of Unresolved Warranty Issues.* RWC and its builder members have been very successful at persuading courts to recognize and enforce the warranty’s mandatory binding arbitration provision. Courts across the country have removed cases from the courthouse and directed them to arbitration under RWC’s Limited Warranty Program.

A good example can be found in this case study. RWC had issued a warranty on a home that was in Year 1 of home warranty coverage, and the homeowners filed a lawsuit against the builder. The builder was well-equipped to defend himself with the warranty book, the application for warranty and his own contract, which included language that made the RWC builder warranty, including the warranty’s binding arbitration language, applicable to any alleged warranty defects in the home. Even though the homeowners argued that RWC’s warranty should not be enforced in that state, the court endorsed RWC’s warranty, and the motion brought by the Builder to compel arbitration and dismiss the homeowners’ lawsuit was granted in its entirety.

Consequently, the homeowners initiated a request for home warranty performance with RWC. Prior to arbitration, the warranty provides for informal mediation. The parties agreed to use RWC’s mediation to try to settle the disputes about the alleged house warranty defects. RWC became actively involved mediating between the homeowners and the builder. Through this mediation, communication between the homeowners and the builder has improved and several items have been amicably resolved. We are encouraged that most, if not all warranty items, will soon be resolved in the same way. At the conclusion of mediation, if any items remain unresolved, the homeowners and builder will proceed to binding arbitration under the terms of the warranty.

This is a real case and a great example of how RWC’s mandatory binding arbitration provision is an effective tool in preventing litigation. It also supports the value of using RWC’s mediation process to resolve disputes about alleged warranty defects in the homes you build.

*Note that the mandatory arbitration provision is removed by the HUD addendum, and thus mandatory arbitration does not apply to home warranties placed on HUD homes.